The Economy Is Up But The Middle Class Is Down

Bloomberg reporters Shawn Donnan and Claire Ballentine join this episode to discuss the results of a new Harris Poll for Bloomberg News, which found that the US Federal Reserve’s rapid increase in interest rates—aimed at fighting inflation—have more middle-class Americans worried about the economy than a year ago, even amid near-record employment.

Read more: Middle-Class Americans Are Rattled by Fed’s Fight Against Inflation

Listen to The Big Take podcast every weekday and subscribe to our daily newsletter: https://bloom.bg/3F3EJAK

Have questions or comments for Wes and the team? Reach us at bigtake@bloomberg.net.

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

Special Report: US and Israel Strike Iran

11:55

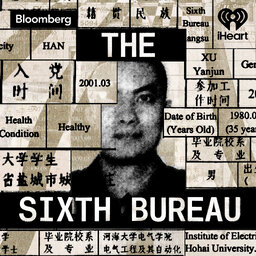

The Sixth Bureau Episode 4: The Duck Analogy

33:40

How the ‘Power Game’ Is Reshaping Venezuela

18:05

Big Take

Big Take