Private Equity’s New Pitch: Investing Your 401(k)

Private equity is looking for new ways to raise capital. The industry has its eye on a $12 trillion piece of America’s retirement market.

On today’s Big Take podcast, private equity reporter Allison McNeely joins host Sarah Holder to explain why PE firms are targeting 401(k)s now and what this could mean for the average American’s retirement savings.

Read more: Private Equity Is Coming for America’s $12 Trillion in Retirement Savings

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

Special Report: US and Israel Strike Iran

11:55

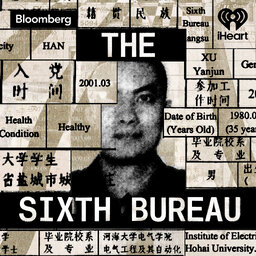

The Sixth Bureau Episode 4: The Duck Analogy

33:40

How the ‘Power Game’ Is Reshaping Venezuela

18:05

Big Take

Big Take