Emmanuel Macron’s Plan to Transform Europe

When he was first elected to lead France in 2017, President Emmanuel Macron promised nothing less than a revolution. Since then, he’s pushed through controversial pension reforms, slashed taxes, and made it easier for French companies to fire employees. Now, he’s setting his sights beyond France.

On the sidelines of the Choose France summit in Versailles, Macron speaks to Bloomberg editor-in-chief John Micklethwait about his bold plan to transform Europe. And he issues a stark warning about what could happen if Europe’s economic growth fails to keep up – not just for the continent, but for global security.

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

Special Report: US and Israel Strike Iran

11:55

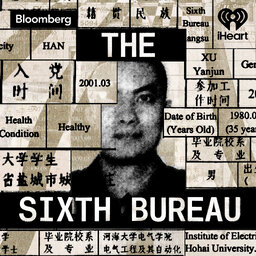

The Sixth Bureau Episode 4: The Duck Analogy

33:40

How the ‘Power Game’ Is Reshaping Venezuela

18:05

Big Take

Big Take