Investors Eye a Return to Russia

As Trump signals a warmer relationship with Putin and a peace deal between Russia and Ukraine comes into focus, optimistic investors and businesses are eyeing potential opportunities in a re-opened Russian economy. But investing in Russia is still a risky bet.

On today’s episode of the Big Take, host Sarah Holder talks to Bloomberg’s Anthony Halpin about why some investors are enthusiastic about Russia’s possible return to global financial markets.

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

Special Report: US and Israel Strike Iran

11:55

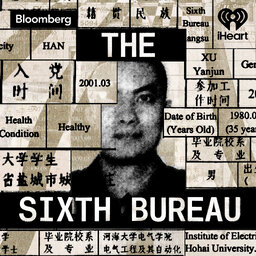

The Sixth Bureau Episode 4: The Duck Analogy

33:40

How the ‘Power Game’ Is Reshaping Venezuela

18:05

Big Take

Big Take