What’s Behind the Global Market Meltdown

On Wall Street, the S&P 500 had its worst day in nearly two years and the Dow Jones Industrial Average shed over 1,000 points. Shares on Japan’s Nikkei Index fell by over 12% — their worst showing since Black Monday in 1987. Cryptocurrencies dropped, bond yields rose and the VIX, known as the fear index, saw its biggest one-day spike in more than 30 years. Is the Fed to blame? AI over-exuberance? Warren Buffett?

On today’s episode, Bloomberg columnist John Authers walks host David Gura through the global market meltdown: what triggered it, how long it could last, and when to panic.

Read more: $6.4 Trillion Stock Wipeout Has Traders Fearing ‘Great Unwind’ Is Just Starting

Further listening: Why the Market’s Big Tailwinds Are Coming to an End

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

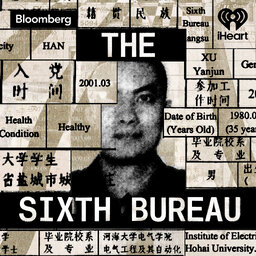

The Sixth Bureau Episode 4: The Duck Analogy

33:40

How the ‘Power Game’ Is Reshaping Venezuela

18:05

Is Apple Winning the ‘AI Scare Trade’?

16:58

Big Take

Big Take