Janet Yellen: The Exit Interview

Treasury Secretary Janet Yellen has been a fixture in the economic policy world for decades. She was President Clinton’s chief economic adviser, a Federal Reserve governor and served as Fed Chair under President Obama.

As her tenure at Treasury comes to an end, Yellen sits down with host David Gura to discuss the possibility of additional sanctions on Russian oil and communication between the US and China, and she reflects on her long career as a pioneering economic policymaker.

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

Special Report: US and Israel Strike Iran

11:55

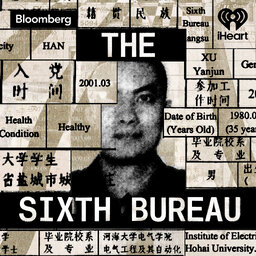

The Sixth Bureau Episode 4: The Duck Analogy

33:40

How the ‘Power Game’ Is Reshaping Venezuela

18:05

Big Take

Big Take