Is the Fed Thinking About Inflation All Wrong?

For over a decade, America’s central bank has had an inflation target of 2%. On Wednesday, the Federal Reserve announced that it would keep its main interest rate unchanged in order to try and get inflation to that magic number. But what if the Fed is thinking about inflation all wrong?

On today’s episode, host David Gura talks to Bloomberg’s Managing Editor for US economic policy Kate Davidson about the reasons the Fed introduced an inflation target in the first place, and Bloomberg Opinion columnist Mohamed El-Erian about the risks if the Fed is wrong about this – and who could be hurt the most.

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

SCOTUS Strikes Down Trump’s Tariffs

18:55

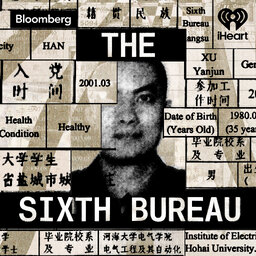

The Sixth Bureau Episode 3: Suck, Squeeze, Burn, Blow

21:28

Trump’s Plan to Dismantle the Department of Education

19:04

Big Take

Big Take