Chinese Emigrants Are Choosing New Destinations - and Transforming Them

A new wave of Chinese people are leaving China after the Covid-19 pandemic and they’re headed to places that aren’t the typical destinations for Chinese immigrants in the past.

Bloomberg’s Lulu Chen tells us how China’s slowing economy, fears over new policies to redistribute wealth and Beijing’s handling of the pandemic created the perfect storm for this exodus. In today’s Big Take podcast, we look at the impact Chinese immigrants who move into these communities in far-flung places have, and what a rising outflow means for China’s future.

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

Special Report: US and Israel Strike Iran

11:55

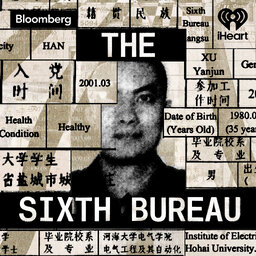

The Sixth Bureau Episode 4: The Duck Analogy

33:40

How the ‘Power Game’ Is Reshaping Venezuela

18:05

Big Take

Big Take