All the Eyes, Ears and Algorithms Focused On the Fed

At the end of last year, the Chair of the US Federal Reserve hinted at cutting interest rates – staving off an expected recession. It was a welcome surprise for many people watching the markets. Five months into 2024, he’s poised to pivot again.

On today’s Big Take, host David Gura talks with Fed editor Kate Davidson and Bloomberg Economics’ Anna Wong about the Fed’s latest moves and what to expect from this week’s Federal Open Market Committee Meeting.

Further Listening: The Federal Reserve's Tricky Economic and Political Terrain, Explained

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

Special Report: US and Israel Strike Iran

11:55

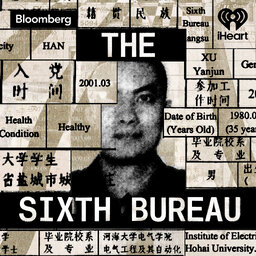

The Sixth Bureau Episode 4: The Duck Analogy

33:40

How the ‘Power Game’ Is Reshaping Venezuela

18:05

Big Take

Big Take