A Frustrated Middle Class Wants More Than Promises In 2024

The American middle class is feeling the squeeze: inflation, wages that haven’t kept up, higher interest rates and fluctuating markets are all adding up to a loss of collective wealth. Bloomberg’s Shawn Donnan and a team of journalists are following the economic lives of two dozen middle class families across the country as we head into the 2024 election. In this first installment we hear from four of them. What does it mean to be middle class in America today–and how will their shifting fortunes influence the way they vote?

Read more: The US Middle Class's Economic Anxiety Will Decide the 2024 Election

Listen to The Big Take podcast every weekday and subscribe to our daily newsletter: https://bloom.bg/3F3EJAK

Have questions or comments for Wes and the team? Reach us at bigtake@bloomberg.net.

In 1 playlist(s)

Big Take

The Big Take from Bloomberg News brings you inside what’s shaping the world's economies with the sma…Social links

Follow podcast

Recent clips

SCOTUS Strikes Down Trump’s Tariffs

18:55

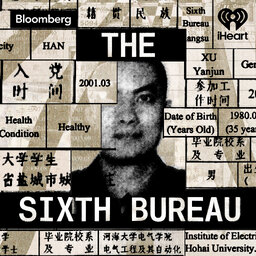

The Sixth Bureau Episode 3: Suck, Squeeze, Burn, Blow

21:28

Trump’s Plan to Dismantle the Department of Education

19:04

Big Take

Big Take