The Trouble With Tariffs: the Smoot-Hawley Act

Tariffs! If you're like most people in the US, you probably didn't think much about the concept until recently -- it's always been one of those historical footnotes. However, the current news about proposed tariffs has the United States and the world overall in a tizzy. So what are tariffs? Why do some people love them, why do some people hate them -- and what can history teach us about the future? In tonight's episode, Ben, Matt and Noel separate the fact from fiction.

In 1 playlist(s)

Stuff They Don't Want You To Know

From UFOs to psychic powers and government conspiracies, history is riddled with unexplained events.…Social links

Follow podcast

Recent clips

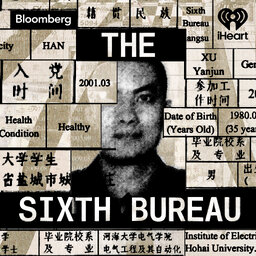

Introducing: The Sixth Bureau

00:58

What is AI Psychosis?

1:23:50

Listener Mail: Lasers, Barack Obama on Aliens, and More

1:00:09

Stuff They Don't Want You To Know

Stuff They Don't Want You To Know