Money and Me: Why no sell-off? How to look beyond the Mag 7, and why cash is really not king now

Markets are rattled by geopolitics - but panic is rarely a strategy.

From US military action in Venezuela to tensions over Greenland, investors are questioning whether uncertainty now warrants a shift in portfolios.

We examine how US equities have actually behaved through geopolitical shocks - and what history suggests about staying invested.

The Magnificent 7 start the year unevenly, raising the question of whether leadership is broadening beyond mega-cap tech into SMID caps.

A weaker US dollar prompts a closer look at currency exposure in global portfolios - risk, opportunity, or both?

With noise rising across geopolitics and policy, we ask the hardest question: sit in cash, or stay the course?

Hosted by Michelle Martin.

Guest: Cheng Chye Hsern, Head of Investment, Providend.

In 3 playlist(s)

Your Money with Michelle Martin (9am - 12pm)

It’s all about Your Money with Michelle Martin from 9am to 12pm. How to save, invest and make the be…Social links

Follow podcast

Recent clips

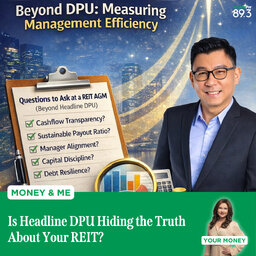

Money and Me: Is Headline DPU Hiding the Truth About Your REIT?

23:01

Market View: Oil at $100, China’s AI Lobster Craze & Adobe’s AI Reckoning

19:24

Money and Me: What you need to know about CPF’s 2028 new investment scheme today!

18:31

Your Money with Michelle Martin (9am - 12pm)

Your Money with Michelle Martin (9am - 12pm)