Markets Extra

Playlist by Markets ExtraThe financial markets have so much to offer beyond mere numbers and charts. Between the highs and the lows, amidst the bulls and the bears, there are plenty of themes to explore. Join Han Tan, Exini…Follow the podcast:

26 clip(s) in playlist

Is trading and investing the new saving?

All we tend to hear these days is that inflation has gone through the roof, and that not investing or not trading can sometimes pose a higher risk than simply saving. Is this always true though? There are a few ways to create wealth, and they ladder up to three pillars: Saving, investing, and trad…

14:58

Fear : A trader's friend or enemy?

Heights, injections, ghosts, lightning – everyone has a fear or phobia. In fact, when it comes to heights, traders can fear those that are on a chart rather than on a rooftop. It is an unpleasant feeling, yet this is a primitive emotion that has been hardwired into us to protect us from danger. Iro…

14:34

5 Reasons Trading Is Like Pro Sports

Tokyo Olympics, Euro 2020, and Wimbledon have spoiled sports fans this past summer. Amidst the sporting spectacle, there are some key lessons that traders can learn and use in the financial markets. Tune in as Han Tan and independent analyst Jamie Dutta discuss the similarities between professiona…

21:48

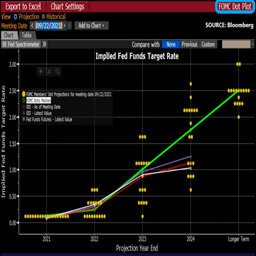

Q4 Outlook: Fed dots and the 'double-D' risks

The Fed has just concluded its September policy meeting, with Fed Chair Jerome Powell revealing that the central bank could begin tapering its asset purchases from November onwards. Tune in as Han Tan and Exinity Chief Market Strategist Hussein Sayed discuss what the Fed’s latest announcement migh…

14:11

Will the ECB join the tapering club?

Key officials at the European Central Bank have begun mulling out loud about whether it’s time to unwind its emergency bond purchases that have supported the Eurozone’s economic recovery. Such a move would have major implications on EU stocks, bonds, and the euro. Tune in as Han Tan and Exinity Ch…

12:45

Everyone is born a trader!

Taking the first steps into the world of trading can be daunting. Yet, we may be more prepared for it then we think. It may even be something we've unknowingly trained for all our lives. Tune in as Han Tan and FXTM Trading Educator Theunis Kruger discuss how we might already be set to tackle the g…

17:37

Confused by the Fed? So were the markets.

The FOMC just wrapped up their July meeting, with markets still left questioning exactly when policymakers plan to start tapering (easing up on their bond purchases that have helped financial markets since the pandemic). Tune in as Han Tan and Exinity Chief Market Strategist Hussein Sayed digest t…

10:20

Could US stocks reach new record highs this earnings season?

The US earnings season is upon us once more as publicly-listed US companies unveil how their respective businesses performed in Q2. Market optimism ran high in the lead up, pushing benchmark US stock indices such as the S&P 500 and the Dow Jones index to new record highs at the start of the week. …

15:08

OPEC+ Preview: Could a cautious cartel pave the way for $100 Brent?

On 1 July, OPEC+ will decide its collective output levels for August. Markets are expecting a hike of around 500k barrels per day (bpd), with Brent futures trading around their highest levels since October 2018. Still, OPEC+ must be wary about how a potential US-Iran nuclear deal could disrupt the…

13:45

Fed discos to taper-town!

The Fed has delivered a hawkish surprise after the conclusion of its policy meeting this week. In the immediate aftermath, the US dollar soared, gold prices tumbled, and US stocks are pulling away from their record highs. Han Tan and his guest, Exinity Chief Market Strategist Hussein Sayed unpac…

15:54

Markets Extra

Markets Extra