Tesla Stems the Bleeding, SpaceX Set to Destroy

Tuesday was a big day in the world of Tesla, which reported its second-quarter sales numbers. After a disastrous start to 2024, and despite year-over-year sales being down, the numbers weren’t that bad. David, Dana and Max talk it out with Bloomberg senior editor for autos Craig Trudell. Plus we have a lot of SpaceX and X news.

In 1 playlist(s)

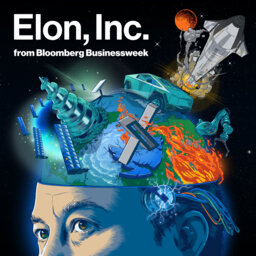

Elon, Inc.

Elon Musk’s sprawling business empire has granted the billionaire a degree of power and global influ…Social links

Follow podcast

Recent clips

Introducing: The Mishal Husain Show

02:19

Everybody's Business: Will the Shutdown Lead to DOGE 2.0?

42:18

Everybody's Business: Elon Inc's Host Explains the Mess in Argentina

42:48

Elon, Inc.

Elon, Inc.