Tesla Slows Down, X's Value Drops and 2024 is Just Getting Started

Over the past decade, Elon Musk’s car company has transformed itself from a niche brand with a novelty product into a major automotive manufacturer and clear market leader. And yet, Tesla Inc.’s leadership position in electric cars is slipping. On Jan. 2, the company reported it delivered almost 485,000 vehicles to customers. The figure was in line with Wall Street expectations, but slightly less than that reported by China’s BYD Co., which delivered roughly 526,000 electric cars. On the latest episode, our panel discusses how BYD became Tesla’s most important competitor, even though it doesn’t sell cars in the US.

Also: in another setback for Musk, his social media platform’s value continues to fall. The asset manager Fidelity again wrote down X’s valuation, according to a news report. Musk paid $44 billion for Twitter in late 2022; its value has since fallen by more than 70%. Lots to talk about.

Finally, we offer predictions for 2024, including the prospect of further Musk feuds with the US government, his potential impact on the 2024 election and his new friendship with far-right Italian Prime Minister Giorgia Meloni.

In 1 playlist(s)

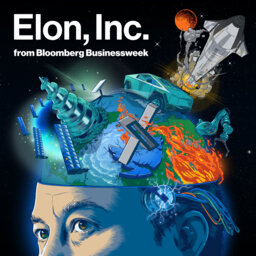

Elon, Inc.

Elon Musk’s sprawling business empire has granted the billionaire a degree of power and global influ…Social links

Follow podcast

Recent clips

Introducing: The Mishal Husain Show

02:19

Everybody's Business: Will the Shutdown Lead to DOGE 2.0?

42:18

Everybody's Business: Elon Inc's Host Explains the Mess in Argentina

42:48

Elon, Inc.

Elon, Inc.