The story Elon isn't posting about... (Hint: It's Tesla's stock price)

Lately, Tesla has been one of the stock market’s biggest losers. Since the beginning of the year, the company has dropped about $200 billion in market capitalization, making it the single-worst performing stock on the S&P 500. The spiral has come amid a storm of negative headlines—especially regarding slowing growth in electric vehicle purchases—a category Tesla has long dominated. Worse for Tesla, some of the most negative headlines were ones caused by Musk’s own erratic decisionmaking.

To discuss why Tesla’s stock is falling and what it might mean for Musk’s larger empire, we brought in senior reporter Esha Dey, who covers stocks for Bloomberg.

We also return to Elon’s alleged drug use. A necessary ingredient in his success to some, but insiders’ fear that Elon has become self-destructive and could eventually cause investors to rethink their beliefs.

In 1 playlist(s)

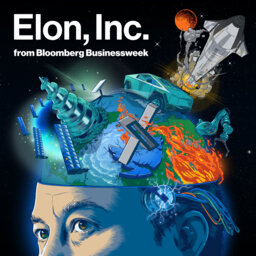

Elon, Inc.

Elon Musk’s sprawling business empire has granted the billionaire a degree of power and global influ…Social links

Follow podcast

Recent clips

Introducing: The Mishal Husain Show

02:19

Everybody's Business: Will the Shutdown Lead to DOGE 2.0?

42:18

Everybody's Business: Elon Inc's Host Explains the Mess in Argentina

42:48

Elon, Inc.

Elon, Inc.